Institutional investors from all over the world together contribute to the energy transition and the consideration of climate risk

The OPSWF initiative is a forum that brings together the world’s leading institutional investors, to promote the ecological transition of the economy. Because of their size and the volume of their investments, these stakeholders are key to driving the ecological transition. Together, these financial institutions commit to accelerate efforts in analysing and considering climate-related risks and opportunities in large-scale asset management and to support the objectives of the Paris Agreement.

OPSWF is a coalition of sovereign wealth funds committed to integrating financial opportunities related to green growth and climate risks into the management of their assets. It was launched by six founding members at the One Planet Summit held in December 2017. Its founding members are the funds of the United Arab Emirates, Kuwait, New Zealand, Saudi Arabia and Qatar. The Coalition gradually extended to asset managers (the “One Planet Asset Managers – OPAM” initiative, in 2019) and to private equity and investment firms (the “One Planet Private Equity Funds - OPPEF” initiative, in 2020). There are currently 46 members (18 sovereign wealth funds, 18 asset managers, 10 private equity and investment firms) which together manage or hold more than 37 trillion dollars of assets. The main deliverable of the OPSWF is its ESG framework, its application is the subject of annual reports, listing the actions likely by the members of the OPSWF.

On 6 July 2018, the OPSWF founding members published the One Planet Sovereign Wealth Fund Framework. This document sets out the principles enabling sovereign wealth funds to consider climate change systematically in their decision making and how, together, they can support ambitious global programs to combat climate change.

On 5 October 2022, the OPSWF Network published the One Planet Climate Disclosure Guidance for Private Markets. This document provides clear and actionable articulation of increasing levels of climate data disclosure from private market participants. Its purpose is to offer guidance on disclosures to help implement TCFD recommendations.

For more information, please visit https://oneplanetswfs.org/.

On the occasion of the last OPSWF Summit on October 5 and 6, 2022, which was held in Abu Dhabi, an updated version of the Companion document listing the good practices of members was published, without any particular modification of the level of ambition of the coalition. However, OPSWF highlighted progress on its three workstreams:

- Harmonization of climate data for private markets based on the TCFD framework; disclosure guidance was released at the summit to encourage stakeholders to release their climate-related data;

- Acceleration of investments in clean hydrogen; a briefing note on the subject calling for unlocking investment was also published;

- Accelerating investments in renewable energy in emerging and developing markets.

The OPSWF has also just structured itself in a permanent way in the form of an association law 1901 and claims to be in a phase of consolidation of its members (currently 46) by welcoming only two new private equity players and a manager of assets announced at the Summit.

A voluntary framework for action based on three fundamental principles:

- Embedding the consideration of climate change issues, aligned with sovereign wealth funds’ investment horizons, into decision making,

- Encouraging companies to address climate change challenges, by incorporating them in their governance, strategy, risk management and reporting activities,

- Taking into account the risks and opportunities related to climate change in investment management, to improve portfolio resilience over the long term. All the parties to this initiative, sovereign wealth funds, asset managers and private equity funds alike, have committed to supporting the implementation of the Framework and its three principles.

The coalition is continuing its work around the following themes:

- Helping to raise sovereign wealth fund capital, innovate, and develop investment opportunities that are more closely aligned with the objectives of the Paris Agreement.

- Accelerating efforts aimed at incorporating climate-related financial risks and opportunities in large-scale, long-term asset management.

- Leveraging the breadth and benefits of knowledge sharing, while staying flexible and agile.

The One Planet Sovereign Wealth Fund Research Forum contributes to a joint effort, one that works towards identifying and facilitating promising and relevant research projects to implement the Framework. The Forum also provides content on sustainable finance research and engages a conversation with OPSWF, OPAM and OPPEF members on that topic.

"I am pleased that members of the One Planet Sovereign Wealth Funds and One Planet Asset Managers, responsible for nearly 30 trillion dollars of assets, are today pledging their support for the TCFD [the main guidelines set out by the Task-Force for Climate--Related Financial Disclosures]. This group will play an important role in systematically embedding climate-related disclosure in the companies in which they invest. This will help reveal the investment risks and opportunities in the transition and ensure that every financial decision takes climate change into account." - Mark Carney, Special United Nations Envoy on Climate Action and Finance

The One Planet Sovereign Wealth Funds (OPSWF) Network has demonstrated that increased cooperation among Sovereign Wealth Funds, Asset Managers and Private Equity Funds can contribute to the systems change we need to address climate change. The three Statements that were published today on climate data, clean hydrogen and renewable energy in developing economies give clear signals to the markets about concrete solutions that can be implemented quickly and at global scale. It is an honour to welcome in Paris the establishment of OPSWF as a permanent association that can sustain these efforts for years to come.

Emmanuel Macron, President of the French Republic

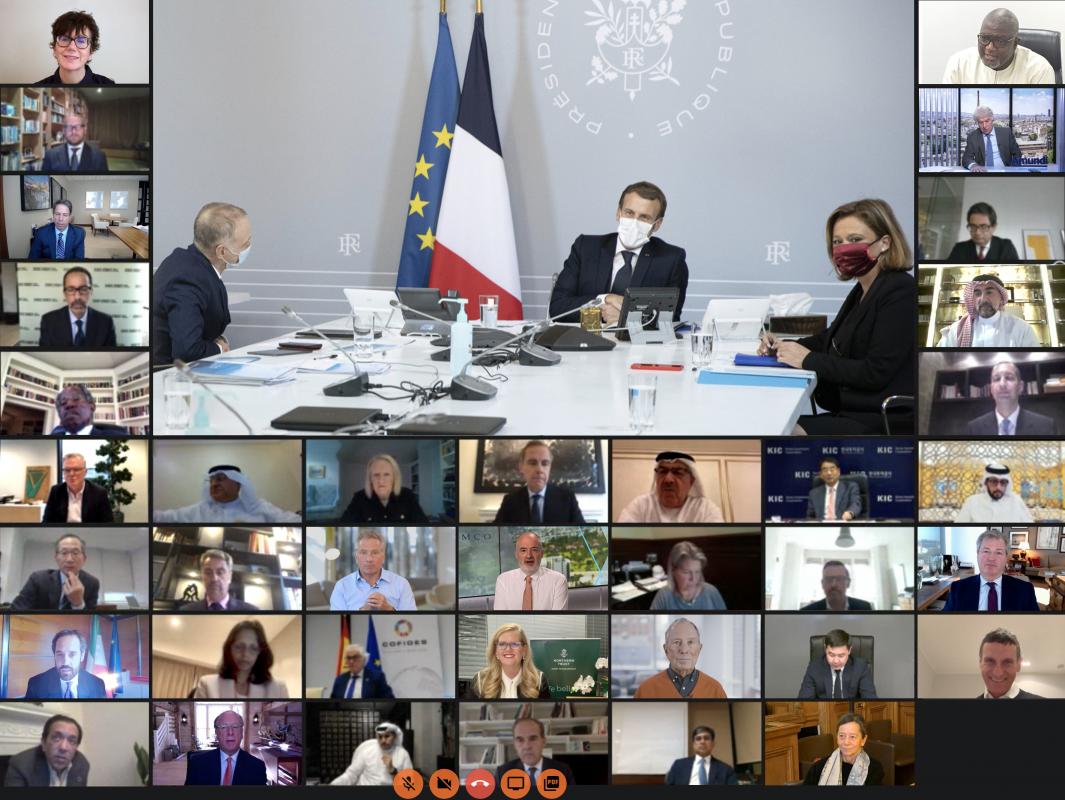

The 33 members of the coalition, leaders from the world’s largest institutional investors, took part in a video conference hosted from the Élysée Palace on 20 November 2020. The meeting provided an opportunity to review the initiative’s tangible results at the OPSWF annual summit. (Cf. Mosaïque sommet)

Voluntary adoption of the OPSWF Framework: the objective is for all the members’ investment mandates to be aligned with this framework. Examples of tangible progress can be found here.

- 2019: launch of the One Planet Sovereign Wealth Fund Research Forum, established in partnership with the Global Research Alliance for Sustainable Finance and Investment (GRASFI), bringing together 22 international research universities.

- November 2020: commitment from members of OPSWF and OPAM to support the recommendations of the Taskforce on Climate-Related Financial Disclosure (TCFD) and to encourage their implementation throughout the value chain.

- February 2021: Publication of a study in partnership with the International Forum of Sovereign Wealth Funds (IFSWF): Mighty oaks from little acorns grow: Sovereign wealth funds’ progress on climate change. This study marks new ground, as this is the first time that sovereign wealth funds have been surveyed to assess their commitment to combating climate change. Read the report

For more information

A joint secretariat operates across the coalition’s three components (OPSWF, OPAM and OPPEF), each having its own independent governance framework. In 2020, the five founding sovereign wealth funds (ADIA, KIA, NZSF, PIF and QIA) created a Steering Committee to discuss and approve the OPSWF annual work programme. The decisions taken by this Committee are not binding on voluntary commitments from other members and initiatives (OPAM, OPPEF).

The list of OPSWF members can be found at the following address: www.oneplanetswfs.org

Find the press release of OPSWF's 6th annual summit: here.